Poverty and rising income inequality is an issue dominating every corner of the United States, even if some neglect to see it. Income inequality refers to the gap between the richest and everyone else, constantly looming over those who remain at the bottom. Life is expensive, so is school.

Currently, the income inequality gap in the United States is the largest in over 50 years. Recent reports are showing that income inequality has grown from 2017 to 2018, despite the apparent economic expansion in the country. This means that despite efforts made, income inequality is going nowhere anytime soon.

So, the richer are getting richer, while those in poverty continue to descend. Unfortunately, this is nothing new. However, the issues with this increasing poverty have continued to evolve, reaching life-threatening levels. For those living in poverty, specifically women, their life expectancy has dropped lower than that of their parents. With the divide widening every day, the rift between our nation has never been more apparent.

Educational Divide

For families and students who are on the lower end of the poverty line, this divide has never been more apparent. While schooling has improved in many places, costs have risen alongside these improvements. Laptop fees, class fees, club fees, field trips, AP testing fees, SAT fees, ACT fees, and so much more remain a detriment to lower-income students. While few of these are technically ‘necessary’, the simple truth is that to get into a good college, with scholarships, these are absolute necessities.

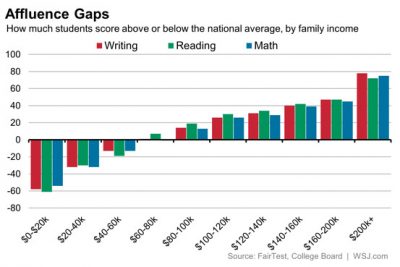

In a single public school, there can be students from a wide variety of socioeconomic backgrounds. On one hand, this allows for good social integration between people of various backgrounds. On the other hand, students from low-income households face an uphill battle with their schooling and standardized test scores. These students struggle to gain the necessary preparation for the test, while their peers pay for one-on-one tutoring and SAT prep. The result is easily predicted, with higher income students who can afford this extra help dramatically improving their scores, while those from low-income families struggle to improve their scores by a few points.

This is not a matter of personal intelligence or the education system, but personal accessibility to tutors and other forms of assistance. High achieving students can be found across every end of the wealth spectrum, but there’s a startling divide between low-income and high-income students. In our nation, only 8 percent of high-achieving students with low-income even apply to a selective college. These students, who scraped together the money to pay every club fee, pay for every exam, and worked relentlessly for their future, are scared away. By what? The price.

For those of us who are forced to fret over the price of every purchase, college is a daunting monster. It hangs over our heads, the solution to all our problems, while simultaneously epitomizing the issue. Just what is needed, but too expensive to be practical without help. Even with student aid, grants, scholarships, and a job-students who attend college struggle to get by. However, more colleges have begun to improve their student aid and work-study programs, opening new avenues to low-income students. Only time will tell the effectiveness, but it’s a step in the right direction.

Closing the Gap

The question our nation is left with is simple: How do you solve such a complex issue? The answer, like the problem, is incredibly complex and beyond the control of many. Gender and race often factor into the issue, primarily when it concerns wealth (assets owned minus any debt).

Solutions have been proposed throughout the years, boosting the rights of unions, cracking down on white-collar crime at wall street, infrastructure funded by the 1-percent, and hundreds more. But ultimately, finding a solution lies in the hands of voters and those they elect to office. Besides bettering yourself through education, something not everyone can do, the only solution will lie with the choices made by the government. This issue is too monstrous, too expansive, to be helped by the average everyday citizen.

With the 1 percent unlikely to begin redistributing the wealth, it will be up to the government to take action. Be it through better taxation, infrastructure, or other means, they will eventually be forced to take definitive action.